“Arbeitnehmerüberlassungsgesetz”

Outside of direct employment there are two principal routes to market in Germany; the freelance contract model or the AUG leased worker model.

It is easy to fall foul of German employment/tax legislation, to avoid non-compliance the AUG/Labour Leasing route is one that many of our clients have adopted. Capital International is one of a few UK employment businesses to hold an AUG Licence and have done so since 2009.

Below are some of the main points you need to know if you are considering working through the AUG option, however our fully trained specialists are happy to talk you through the detail.

What is AUG – Arbeitnehmerüberlassungsgesetz?

AUG is a German labour leasing licence system and is being increasingly adopted by companies to ensure that all their contractors are working compliantly under the German tax system. This also protects contractors from any infringements of German tax law.

How does AUG work?

Capital International effectively employs contractors for the duration of the contract under the AUG licence. Working under AUG a contractor is paid a NET monthly salary and Capital will take care of all of the German Tax and social security contributions within that hourly rate negotiated at the start of the contract.

Capital can help you with AUG!

Visit our page to find out how we can help you offer an AUG solution to your clients.

Find out more!Why working in Germany is a great move:

Holiday Pay

Under AUG contractors will accrue holiday pay which will enables them to take up to 30 days’ paid holiday per year (this includes bank holidays). More holiday can be taken as agreed with the client but this may be unpaid. Any unused holiday pay will be paid at the end of the contract. Holiday pay is paid at a standard day rate not the normal hourly rate x by number of hours.

Health Insurance

In Germany you are legally obliged to take up either private or public health insurance. Contribution to public health insurance are made by Capital, or alternatively a contractor can choose to be paid an allowance and arrange for their own private health insurance from an approved supplier. Sick pay is also accrued.

Expenses

At the end of the tax year the contractor will file a tax return with the German authorities who will recalculate the contributions and return any money. Expenses which are tax deductible include travel between home country and Germany and accommodation in Germany (if this is a second residence).

Payments

Capital International pay all AUG contractors a monthly salary which is adjusted according to hours worked in form of a flexible bonus.

Practical tips to ensure your transition to working via AUG in Germany

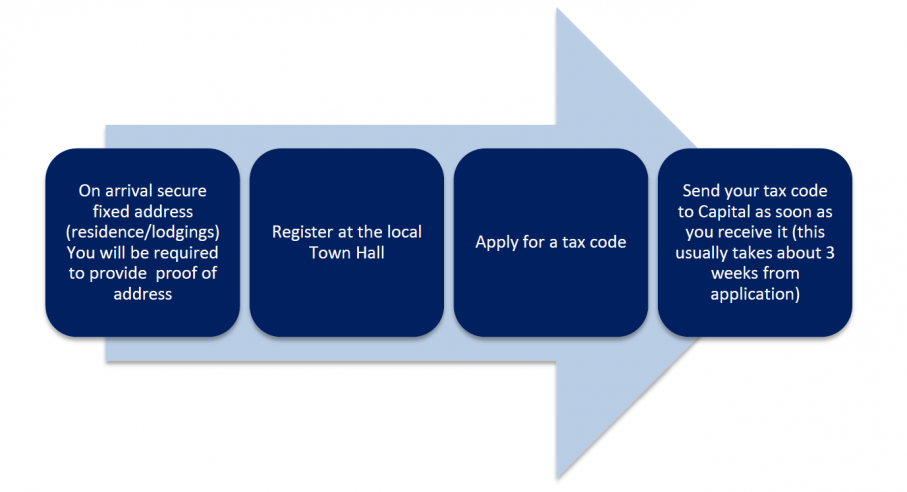

It is vital that contractors set up their tax numbers as early on in the process as possible (you need to be resident in Germany to do this). Failure to do this could result in an emergency tax code being applied. Any overpaid tax being refundable only once you have completed a tax return at the end of the calendar year. To enable you to get a tax code you need to do the following:

Registration Process: